Retirement income tax calculator 2021

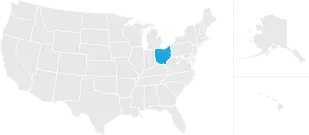

General Pros and Cons of a 401 k Pros Tax-deferred growthSimilar to traditional IRAs or deferred annuities. 16 of their pre-retirement income from.

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

You can use this calculator to help you see where you stand in relation to your retirement goal and map out.

. The mobile-friendly Tax Withholding Estimator replaces the Withholding Calculator. The 2021 deferral limit for 401 k plans was 19500 the 2022 limit is 20500. Automated Investing With Tax-Smart Withdrawals.

Retirement tax calculator 2021 Jumat 09 September 2022 Edit. So in this case they should aim for 12. WASHINGTON The new Tax Withholding Estimator launched last month on IRSgov.

For example in the 2021 tax season if you earn 80000 you will be in the 49020 to 98040 tax bracket with a tax rate of 205. Figure your monthly Federal income tax withholding. In 2022 it is 12950 for single taxpayers and 25900 for married taxpayers filing jointly slightly increased from 2021 12550 and 25100.

For instance a person who makes 50000 a year would put away anywhere. 2021-2022 Tax Brackets. Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or 401-k Retirement Plan 2022 Early Retirement Account Withdrawal Tax Penalty Calculator Important.

Your retirement is on the horizon but how far away. IR-2019-155 September 13 2019. Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more.

You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. Free step-by-step webinar September 19. For example the total return including dividends of the SPTSX Composite Index for the 10 year period.

Enter your filing status income deductions and credits and we will estimate your total taxes. This rule suggests that a person save 10 to 15 of their pre-tax income per year during their working years. This means that you are taxed at 205 from.

Between 25000 and 34000 you may have to pay income tax on. You can use this calculator to help you see where you stand in relation to your retirement goal and map out. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds.

Social Security Tax Changes for 2013 - 2022 High incomes will pay an extra 38 Net. We have the SARS tax rates tables. The Income Tax Calculator estimates the refund or.

Office of Personnel Management. Based on your projected tax withholding for the year we can also estimate. Your household income location filing status and number of personal.

Federal Employees Group Life Insurance FEGLI calculator. The actual rate of return is largely dependent on the type of investments you select. Use our retirement calculator to help you understand where you are on the road to a secure retirement.

Our income tax calculator calculates your federal state and local taxes based on several key inputs.

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

What Will My Savings Cover In Retirement Fidelity

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Tax Withholding For Pensions And Social Security Sensible Money

Tax Withholding For Pensions And Social Security Sensible Money

Ohio Retirement Tax Friendliness Smartasset

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How To Calculate Federal Income Tax

How Is Taxable Income Calculated How To Calculate Tax Liability

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Federal Income Tax Calculator Atlantic Union Bank